The charges and fees on pensions with a drawdown facility can vary considerably depending on which provider you choose.

Under pension drawdown (also called “income drawdown”) you are permitted to take money from your pension funds as and when you want to. At the same time you may leave the remainder invested whilst still in retirement.

Here are the sorts of costs you would typically pay when taking advice in setting up a drawdown pension, these fees can vary depending on your situation. We can break these costs down as follows:

How much does a drawdown pension cost?

Choosing the right pension drawdown product for you

Speak to an income drawdown expert

How much does a pension drawdown cost?

The costs involved in pension drawdown are individual/pension specific.

All providers will work to different terms and the associated costs could have a big impact on how much you end up paying. Typical pension drawdown charges include (but are not limited to):

Set-Up Fees - Typically a standard fee

Administration Fees - Typically a standard fee but some lenders may calculate costs based on how much you have in your pension pot.

Fee(s) on withdrawal(s) of the 25% tax-free sum - Some providers don’t charge for any withdrawals of the 25% tax-free sum, others may charge a fee (set or variable) per withdrawal

Fee(s) on additional withdrawal(s) over 25% tax-free sum - Some providers don’t charge for any withdrawals of the 25% tax-free sum, others may charge a fee (set or variable) per withdrawal

Income Tax charged on each additional withdrawal - Withdrawals outside the 25% will be added to any other income you have which could impact how much Income Tax you pay

Fees for ongoing pension drawdown management - Some providers will charge a set fee, but many will charge a percentage of your pension funds

Transfer fee / exit charges - Typically a standard fee

You would be advised to carry out a pension charges comparison to find out which income drawdown product is best suited to you before you commit to a product.

Choosing the right pension drawdown product.

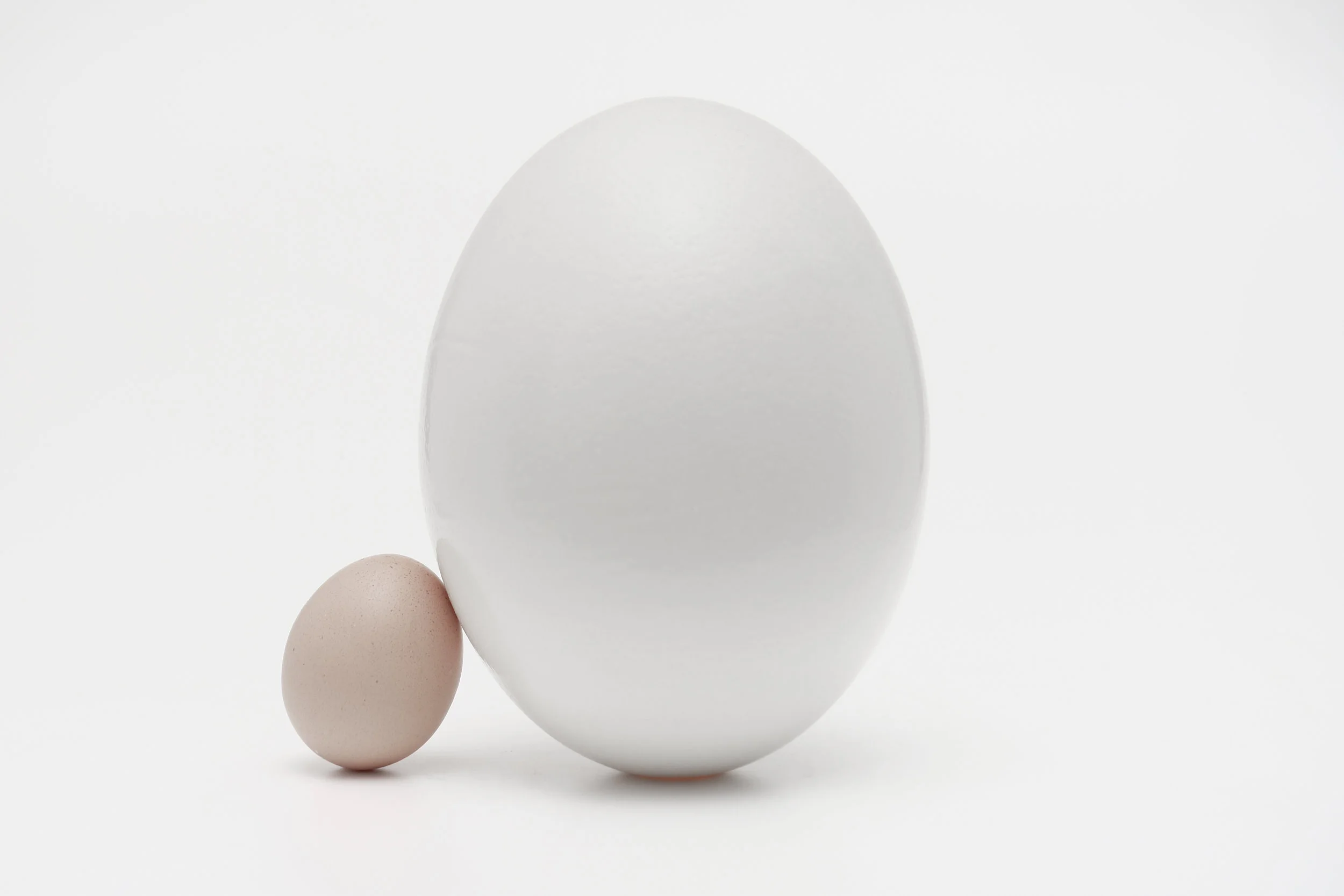

The first 25% of your pension is tax-free, irrespective of whether your fund is £40,000 or £400,000. After that HMRC consider the remaining 75% to be earned income and therefore taxable. The amount you take after the initial 25% could potentially limit how much you can pay into a pension in the future.

You should be aware that by taking any income outside of your 25% tax-free allowance could potentially put you in danger of being pushed into a higher tax bracket, as these funds will be added to any other taxable income you have.

You also should be aware of the lifetime allowance as further tax may also apply if the value of your pension savings exceeds £1,030,000 when you access the funds.

Speak to an income drawdown expert

We can arrange a free pension review for you today.