Please click here to visit the Government site which will provide you with information on the basic state pension.

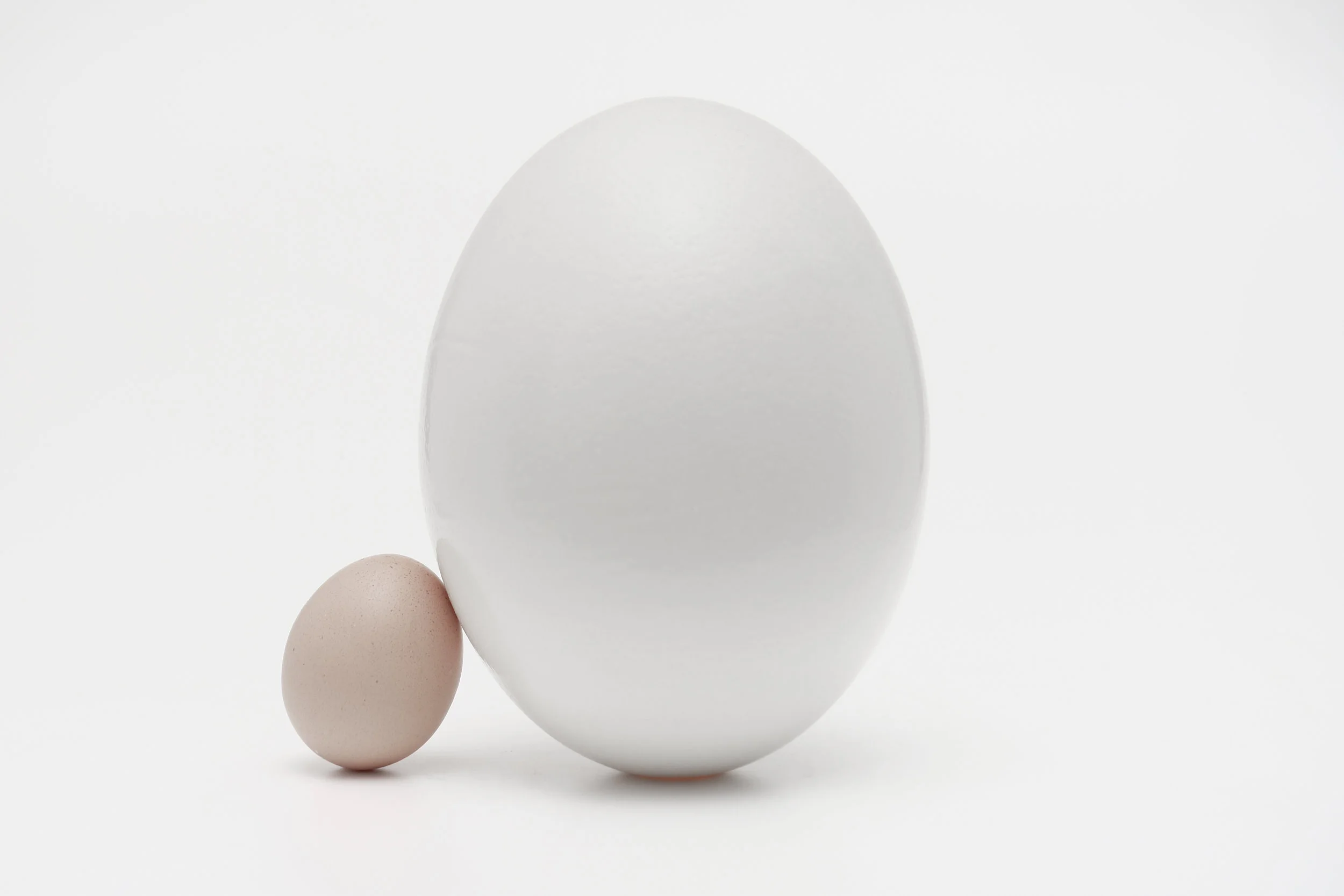

The potential shock awaiting retirees

The potential shock awaiting retirees

A study in April 2109 shows there could be an unwelcome surprise for those who save too little, too late.

How much income do you think you’ll need in retirement? *1

Research shows that UK investors expect to need an income equal to two-thirds of their current salary to afford to live comfortably. Yet, the average amount received by today’s retirees is far less, at 53% of final salary.

This gap spells disappointment for those individuals and couples who do not have the funds to support the lifestyle they would like in retirement. It also raises the rather difficult question of how much of our salary we should be putting away to maintain our lifestyles after we stop working.

According to research by Schroders, a 25-year-old who would like to retire on a two-thirds pension at 65 should be tucking away 15% of their salary each year.

At that savings rate, an average annual return of 2.5% above inflation would create a pot large enough to produce a retirement income to meet their target.

But if that person was to save 10% of their salary, the annual return they’d need would shoot up to 4.2% over inflation.

If they were to save only 5% of their salary (the current overall minimum contribution rate for auto-enrolment), they may need returns that exceed inflation by 7%.

Unfortunately, history is not on the side of investors relying on achieving that rate of return over the medium to long term.

The Schroders research revealed general acknowledgement by non-retired people that they need to be saving more to achieve the standard of living they want in retirement. The difference between what they are saving, and what think they should be saving, was the biggest amongst Generation X – individuals aged between 37 and 50 – indicating perhaps a growing concern that they are at risk of leaving it too late.

“To have the best chance of a comfortable retirement, the lesson for younger workers is to start saving early,” says Lesley-Ann Morgan, Head of Retirement at Schroders. “Leaving retirement saving until you are nearing your 50s and 60s is likely to be too late to make up the savings gap.”

It’s about time

Some experts suggest that if you leave retirement saving until age 40, then you’ll need to put away at least 20% of your income – and that you should maintain this percentage as your earnings increase.

If that's a tall order, there might be other opportunities to boost your savings rate; for example, a bonus or inheritance could make a big difference to your long-term prospects. So, if you have surplus cash that is not earmarked for other purposes and you haven’t used all your pension allowances, making a one-off pension contribution can be a smart way to get nearer that retirement goal.

Time is your biggest ally when it comes to saving, thanks to the power of compounding. But that doesn’t mean there aren’t significant opportunities to catch up, and the end of the tax year presents an ideal opportunity to do so.

Source: 1 Schroders, Global Investor Study 2018

So what is a good pension pot at 55?

According to Scottish Widows, someone who has left pension saving to their 50s would need to put away £1,445 a month to achieve a £23,000 annual income at retirement.

This estimate was derived using The Telegraph Pensions Calculator, assuming someone earning £30,000 a year, with contributions being supplemented with a 4% employer contribution. The calculations allow for inflation, both in discounting back the final results so they’re in ‘today’s money’ and in assuming that contributions increase with earnings each year.

If you are in your 50s, make sure you check when you’ll start receiving your State Pension. Research by YouGov for the charity Age UK conducted in December 2018 found that one in four people aged between 50 and 64, equivalent to nearly three million people, don’t know what their State Pension age is.

Source: Schroders

Pensions & Tax Relief

Tax relief on pension contributions explained.

Find out how the government tops up your pension savings in the form of pension tax relief, and use our pension tax relief calculator to see how much you'll get.

What is pension tax relief ?

When you save into a pension, the government likes to give you a bonus as a way of rewarding you for saving for your future. This comes in the form of tax relief. When you earn tax relief on your pension, some of the money that you would have paid in tax on your earnings goes into your pension pot rather than to the government. Tax relief is paid on your pension contributions at the highest rate of income tax you pay.

So:

Basic-rate taxpayers get 20% pension tax relief

Higher-rate taxpayers can claim 40% pension tax relief

Additional-rate taxpayers can claim 45% pension tax relief

In Scotland, income tax is banded differently, and pension tax relief is applied in a slightly alternative way.

Starter rate taxpayers pay 19% income tax but get 20% pension tax relief

Basic rate taxpayers pay 20% income tax and get 20% pension tax relief

Intermediate rate taxpayers pay 21% income tax and can claim 21% pension tax relief

Higher-rate taxpayers pay 41% income tax and can claim 41% pension tax relief

Top rate taxpayers pay 46% income tax and can claim 46% pension tax relief

How pension tax relief works.

If you are a basic-rate taxpayer and were to contribute £100 from your salary into your pension, it would actually only cost you £80. The government adds an extra £20 on top – what it would have taken in tax from £100 of your salary.

Higher-rate (40%) and additional-rate (45%) taxpayers only need to pay £60 and £55 respectively to achieve the same £100 of pension savings.

How do I claim pension tax relief ?

The way tax relief is claimed depends on the type of pension you are saving into, and it’s worth checking with your scheme to see what method it uses, as you might need to do some extra legwork to get the full tax relief you’re entitled to.

There are two main ways:

Pension tax relief from ‘net pay’

A ‘net pay’ arrangement is used by some workplace pensions, and don’t require you to do anything to get your full tax relief.

Pension tax relief at source

‘Relief at source’ applies to all personal pensions and some workplace pensions. So, if you have a private pension with an insurance company, or a self-invested personal pension (Sipp), this will apply to you.

If you’re paying into a pension through your employer, your employer will take 80% of your pension contribution from your salary (technically known as ‘net of basic rate tax relief’).

Your pension scheme then sends a request to HMRC, which pays an additional 20% tax relief into your pension.

Under this system, higher and additional-rate taxpayers must complete a self-assessment tax return to receive the extra relief due to them.

Your pension contributions are deducted from your salary before income tax is paid on them, and your pension scheme automatically claims back tax relief at your highest rate of income tax.

How much pension tax relief can I earn in 2019/20 ?

The government puts a limit on the amount of pension contributions on which you can earn tax relief. This is called the pensions annual allowance.

It has been set at £40,000 for the tax year 2019-20.

Any pension payments you make over the £40,000 limit will be subject to income tax at the highest rate you pay.

However, you can carry forward unused allowances from the previous three years, as long as you were a member of a pension scheme during those years.

Pension tax relief for non-taxpayers and low earners .

Non-taxpayers, including spouses who aren’t in employment and children, are eligible for tax relief of 20%, even though they don’t pay tax.

Remember, you can save 100% of your income into a pension to earn tax relief, so long as it doesn't exceed £40,000 in a year.

So, if you earned £5,000 a year, you could save £5,000 into a pension.

But if you earn £3,600 or less, including people that don't earn any money, the maximum you can contribute is £3,600. This includes the government top-up, so your personal contribution can be no higher than £2,880.

Qualifying recognised overseas pension schemes (QROPs)

‘QROPS’ stands for ‘qualifying recognised overseas pension scheme’. A QROPS is an overseas pension scheme that HM Revenue & Customs (HMRC) recognises as eligible to receive transfers from registered pension schemes in the UK. To qualify as a QROPS the scheme must meet the requirements set by UK tax law, such as being available to residents in that country and not being accessible before age 55 unless under special circumstances. To check if a pension is a QROPS you can check the list of schemes that have told HM Revenue and Customs (HMRC) that they meet the conditions to be a recognised overseas pension scheme (ROPS).

Why might you consider having a QROPS?

If you live overseas or are thinking of moving abroad then you may consider transferring to a QROPS. You may want your pensions to be in the country that you retire to so you are not receiving income in pounds and spending in a different currency, as exchange rates can fluctuate. You may also find it easier to keep track of tax and regulation changes if they happen in the country that you reside. You may be working outside of the UK for an employer that offers a QROPS and you like the benefits offered. In all cases it is recommended that you should take regulated financial advice before transferring to a QROPS and you should consider any guarantees or other benefits that you might lose by doing so. Standards of advice can vary in different countries, so make sure you are confident of the professional standing, qualifications and experience of any adviser that you talk to. Please be aware that transfers to QROPS can be subject to a number of tax charges as listed in the next sections.

When does the 25% overseas transfer tax charge apply?

From 9th March 2017, transfers to QROPS attract a 25% tax charge but there are exceptions. You will still be able to make a transfer tax free if you are transferring to a qualifying recognised overseas pension scheme (QROPS) and formally requested your transfer before 9 March 2017 or one of the following apply: you are resident in the country where the QROPS receiving your transfer is based you are resident in a country in the European Economic Area (EEA) and the QROPS you are transferring to is based in another EEA country the QROPS you are transferring to is an occupational pension scheme and you are an employee of a sponsoring employer under the scheme the QROPS you are transferring to is an overseas public service scheme and you are employed by an employer that participates in that scheme the QROPS you are transferring to is a pension scheme of an international organisation and you are employed by that international organisation If the scheme you are transferring out of does not receive the correct paperwork then they are required to charge the 25% on transfer regardless and you will have to apply for a refund via your scheme at a later date. If you are exempt from the charge on transfer but then your circumstances change within 5 years such as moving to another country or moving your QROPS to another country then you may have to pay the 25% tax charge at that point.

QROPS and the Lifetime Allowance

There is a lifetime allowance of £1 Million that you can have in pension savings in the UK unless you have one of the forms of protection in place. If you are under 75 and transfer out of UK registered pensions into a QROPS the value of the transfer will be tested against the lifetime allowance and if it is in excess of your unused allowance, this could result in a tax charge of 25% on the excess. Conversely, if you are under 75 and transferring into a UK registered pension from a QROPS this will usually result in an enhancement to your lifetime allowance. If either of these situations would apply to you, we recommend that you speak to a regulated financial adviser.

What happens if I transfer to an overseas scheme that is not a QROPS?

If you transfer to an overseas pension and it is not a QROPS then usually you will be classified as making an unauthorised payment from your pension which could result in an unauthorised tax charge of 55% with the possibility of additional penalties. Such a transfer is also unlikely to be regulated and is likely to leave you without any recourse to compensation. You may also find yourself in investments that are not diversified or not suitable to your attitude to risk. In short – the worst that could happen is that you lose all of your money and still find yourself with a tax charge to pay. Be aware of scams, don’t act on the basis of an unsolicited contact and always deal with a regulated financial adviser. If you are contacted out of the blue and suspect a scam, contact Action Fraud http://www.actionfraud.police.uk/

Am I free of UK rules and taxes on my pensions if I transfer?

On transfer your QROPS will have a 10 year reporting requirement to HMRC so that if you breach the rules of a QROPS such as releasing funds before age 55 you could still be subject to a tax charge of 55% plus penalties. For those that have transferred to QROPS before 6th April 2017 you also have to be resident outside of the UK for 5 consecutive tax years by the time you come to retire or take benefits. The period of nonUK residence was extended to 10 consecutive tax years for those that transfer on or after 6th April 2017. UK tax rules can apply for the 5 full tax years after you have transferred to a QROPS regardless of how long you have been non-resident. If you are a UK resident when you take benefits from your QROPS this is likely to be subject to UK income tax. If you are resident abroad you will also need to check the tax rules for that country and the country where your QROPS is based. Before you transfer check what tax you will pay on the pension benefits.

Pension Freedoms and QROPS

Whilst pension freedoms were introduced for defined contribution pensions in the UK, QROPS remained subject to a test that 70% of the fund had to be used to provide income for the rest of your life. This test has now been removed for all QROPS* as of April 2017, and you are allowed to have the same options as members of UK registered pensions. There is also a retirement age test of 55 which has now been modified. The new regulations allow for the following payments before age 55: • a serious ill-health lump sum • a short service refund lump sum • a refund of excess contribution lump sum (where you pay too much into your pot by mistake) • a winding-up lump sum (where you have a small pot and the scheme is wound up) *Including international organisations such as the UN and the EU pension schemes.

Take a pause before transferring

If you move abroad, you do not have to transfer your UK pension pot. You can choose to leave it in the UK and then draw benefits from the UK. Currency risk and exchange commission can be managed by setting up a foreign exchange account and transferring money into your local denomination accordingly. If you are transferring your pension you should make sure you understand the features and options in the new plan you are transferring to and how it differs from your current pension. Look out for any charges you may pay on your current pension for transferring, and check what the set-up and ongoing charges are on the new pension. Since 2013 regulated advisers in the UK are not allowed to charge commission and have to be upfront about the fees they will charge you for pensions advice this is not true in every country. Other fees such as trail paying investments and switching charges need to be looked out for. Also find out how the QROPS will invest your money and whether you have any choice in the type of investments. Consider the level of risk you are happy with. You might be worse off if you transfer your pension abroad. You must get regulated financial advice if you want to transfer from most defined benefit pensions and from some defined contribution pension pots which include a guarantee on how much income you will receive. In some cases this may result in you taking regulated advice in both the UK and the country that you are transferring to.

Source: The pension advisory service

Lost Pensions

If you have lost trace of former pensions you can use the following link to locate pensions. The site is a Government site. Your pensions will be linked to your National Insurance Number.

Please click here to visit the site.